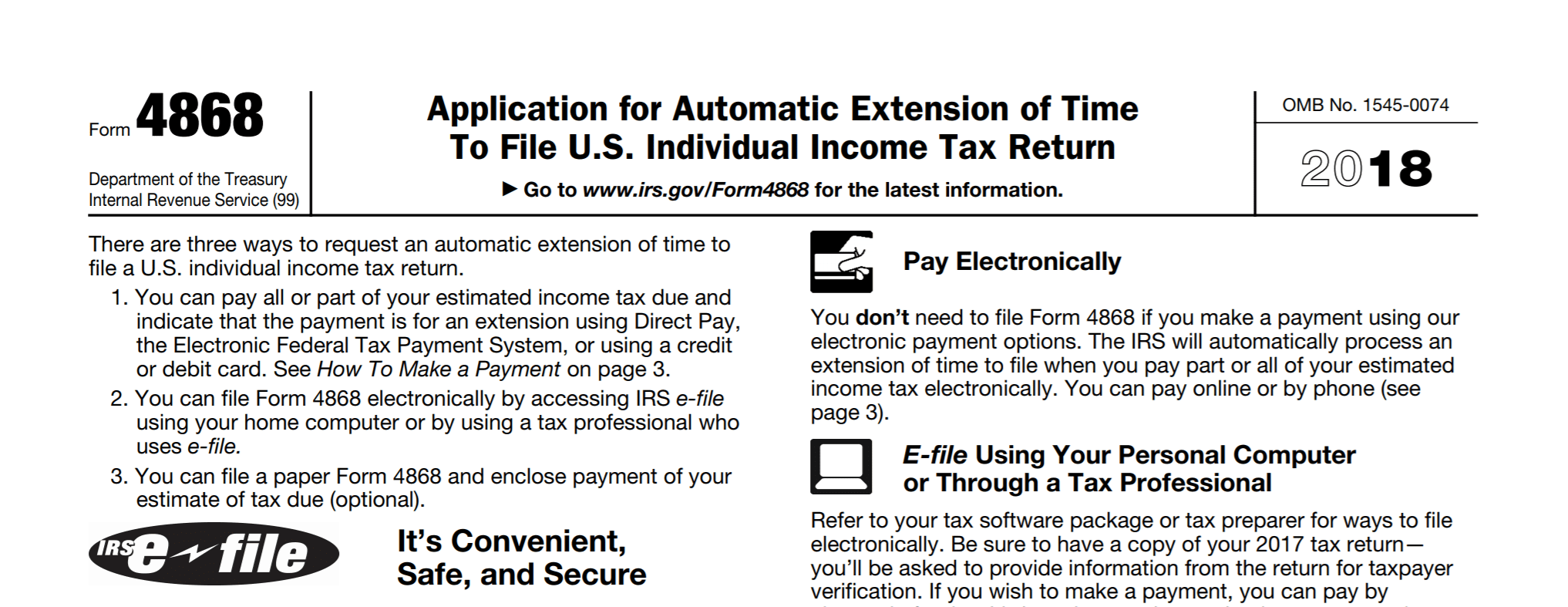

If you need to file for an extension for the first time, or the 20th time, there are a few things you should know before you file.

When filing IRS Form 4868, you’re asking the Internal Revenue Service to allow you some time to file your personal and or business tax return specifically when filing a Schedule C with your personal return as a sole proprietor or as a single-member LLC. In some instances, an extension is automatically filed for members …

Read More

Is your tax preparation being done by an EA or CPA?

While this question may not seem relevant to you, the answer may determine what protections you have and the level of representation you may need should you have to work with the IRS regarding your tax return. If you are like most people, you only think about your tax return when you need to file. Gaining a better understanding of the landscape of tax preparation will help you navigate …

Read More

H.R.1 – The Tax Cuts and Jobs Act is the largest tax reform in the last 30 years. It temporarily lowers personal tax rates and permanently lowers business tax rates from the current 35% to 25%, the lowest it’s been since 1939. This is probably the most controversial item in the tax reform, but it is largely what the reform is basing it’s growth projections on.

According to the Tax Foundation’s Taxes and Growth model, H.R.1 would increase the size of …

Read More

The tax year is ending, but there are a few things you can do to improve your tax return for 2017 and set yourself up with the best footing for 2018.

Standard tax deductions vs itemized deductions

The IRS allows you to reduce your taxable income based on a number of deductions. This results in lower income taxes. Some of these deductions are:

Mortgage interest

Theft loss

Medical expenses

Charitable deductions

Etc.

You can choose to deduct based on your record of items or you can deduct a …

Read More