Oct

18

6 Year End Tax Tips

Whether you are having a good year, rebounding from losses, or struggling to get off the ground, you may be able to save a bundle on your year end taxes if you make the right moves now. What are the right moves and where should you begin? Here’s 6 year end tax tips that will save you money!

Year End Tax Tips

Itemized or Standard Deduction?

The new law greatly increases the standard deduction to $24,000 for married couples filing jointly, $12,000 for single filers. It also places new limits on itemized deductions, including a $10,000 cap on state and local income tax deductions. Taking the standard deduction instead of itemizing may make year end tax preparation simpler.

Make 401K Contributions

Even if you’re nowhere near the top tax bracket, putting as much money as you can into your company’s 401(k) or similar workplace retirement savings plan is a great idea. Since most plan contributions are made before taxes are taken out, you’ll have a bit less income that the IRS can take. (Exceptions to this are contributions to Roth 401(k) plans, where you put away after-tax money and get tax-free growth.) Also, the quicker you put the money into the account, the longer the earnings will grow tax-deferred.

Open IRA

If you have an IRA account or open a traditional IRA, you might be able to deduct at least some of your contributions on your tax return. Even if you won’t get a deduction, you’ll be adding to your nest egg for retirement. Self-employed workers also receive additional retirement saving benefit. There are a variety of plans — SEP IRAs, solo 401(k) plans and others — into which you can put some of your self-employment earnings. If you’re a sole proprietor, your contribution to a self-employed retirement plan also is deductible on your tax return.

Watch Your Healthcare

Medical expenses can blow any budget, and in some cases the IRS is sympathetic to the cost of insurance premiums. Deductible medical expenses have to exceed 7.5 percent of your adjusted gross income to be claimed as an itemized deduction for tax years 2017 and 2018. After 2018, the threshold increases to 10 percent of AGI. However, if you’re self-employed and responsible for your own health insurance coverage, you might be able to deduct 100 percent of your premium cost. That gets taken off your adjusted gross income rather than as an itemized deduction.

Taxpayers who can afford health insurance but who don’t have adequate coverage must pay a fine, which can run into several hundred dollars or more, depending on the size of your family. You’ll owe the fee for any month you, your spouse or your tax dependents don’t have qualifying health coverage, and it’s payable when you file your return. If this situation applies to you, check into coverage now to avoid this pain next year. Medical coverage provided by your employer or through an individual plan with state insurance marketplace generally qualifies as adequate coverage.

Donate To Your Favorite Charity

As you’re putting together your year end holiday shopping list, be sure to include charitable gifts that could help reduce your tax bill. Donate stock or mutual funds that you’ve held for more than a year but no longer fit your investment goals. The charity gets the asset to hold or sell, and your portfolio rebalancing nets you a deduction for the asset’s value at the time of gifting. Even better, you don’t have to worry about capital gains taxes on the appreciation of your gift. Taxpayers who itemize can now deduct charitable contributions of as much as 60% of their adjusted gross income. That could work to the benefit of, say, a retired person with significant assets and modest living expenses.

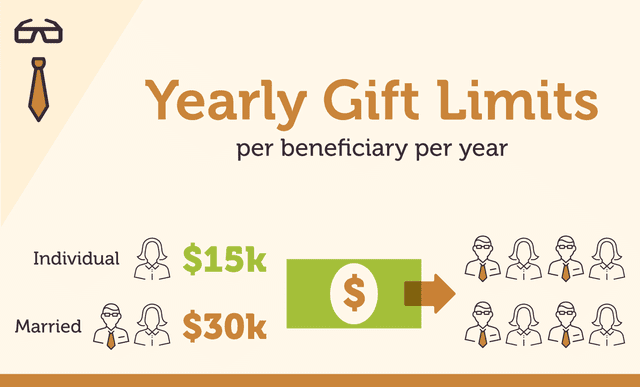

Give Gifts!

You can give as many family members as you like up to $15,000 per year ($30,000 from a married couple electing to split gifts) each without reporting it to the IRS. Generally, your estate will not pay estate taxes on a gift once it is made, and it will not be considered taxable income for the recipient.

Don’t let these year end tax tips pass you by! To save even more money, call us to schedule a consultation today!